Once upon a time, consumers would clip their coupons from their Sunday FSI circulars, take them to the store and turn them in for their discount. Consumer goods manufacturers incented their consumers to try new products, buy multiples or use the FSI as another form of advertising. While the idea of the coupon has not gone away by any stretch of the imagination, how consumers want to interact with them has. Mobile has changed everything – sort of. People want to use their phones for everything including cashing a coupon.

They assume because they can pay for their Starbucks with a swipe of their phone or use a coupon on their phone when they shop at the Gap that they can do the same with coupons in the grocery or big box store. Manufacturers want to take advantage of this trend and deliver mobile coupons to their consumers. Unfortunately, reality makes things a bit more complicated. Consumers and manufacturers are moving faster than the redemption agencies and retailers can keep up and this has made the coupon landscape confusing especially for those either just entering or trying to re-enter after an absence.

So, let’s start with the issue of technology. Retailers and manufacturers work with redemption agencies to be the financial go-between these two entities for coupons. Retailers collect the coupons and send them to the manufacturer’s agency who records and then bills the manufacturer for the coupons redeemed so that the retailers are refunded for the coupon. This is all based on a physical coupon that can be audited and checked for fraud. Simple, right? Not so much when you involve the mobile coupon. The retailer would theoretically scan the mobile coupon and take the discount as they would with a printed coupon. But then what? They don’t have a physical coupon to send to the agency and there is no way to account for fraud. How does that discount get communicated back to the manufacturer? It can be done in theory, but at this point there is no consistent technology that all of the retailers can use. Internal systems are different and while the redemption agencies are working them to come up with a solution there currently isn’t one. What this means is that the product manufacturer needs to come up with alternatives to get mobile coupons to their consumers that want them. You may be asking – why can the retailers do mobile coupons for their stores? The answer is simple, it is their store and/or product so if a mobile coupon is used there is nothing that goes back to the manufacturer, it is just treated like a sale price.

What are the manufacturers to do if they want to engage in mobile coupons? There are options out there and the key is to determine which best meets your needs.

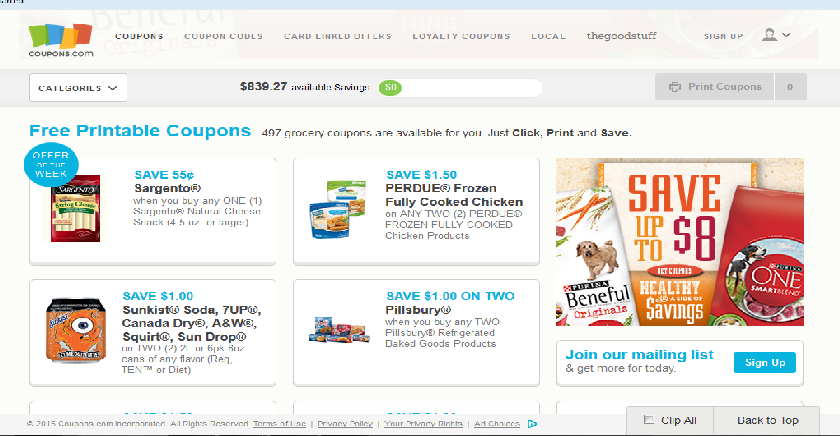

Coupon Apps

There are many coupon apps out there. Some names you may have heard of and others newer – RetailMeNot, Coupon Sherpa, Ibotta. These work by providing coupons to retailers such as Gap, Aeropostal and Babies R Us. The problem here is that it doesn’t support manufacturer’s coupons. A new company, MobiSave, is coming out with an app that allows you to choose your offer and then scan your receipt within the app. The consumer will then get refunded the coupon amount via PayPal.

Load-to-Card

Load-to-Card

Coupons, Inc., News America and a number of others now have deals with the grocery and big box manufacturers to load special offers/coupons directly to your frequent shopper card. When you scan the product at check-out it deducts like a coupon.

Store Coupons

One way to bypass the coupon redemption issue is to create a joint partnership with a retailer such as CVS, Babies R Us, Target, etc. You create an offer that is pushed out to consumers so that it is downloadable onto their phone. The consumer scans the coupon at the register like they would any other retailer coupon.

The Future

One only hopes that the retailers and the redemption agencies get their act together and figure out a solution so that consumers can use their phone for manufacturers coupons. Until then, consumers will have to print coupons from their computer or clip them from the Sunday circular.